Grow with Trade Finance

Unlock your business potential with smart trade finance. Flexible working capital solutions for seamless international trade and sustainable growth

Designed to simplify international trade

Corporate Alliance provides a comprehensive suite of solutions for managing trade-related operations in a seamless manner. Our trade finance solution supports SMEs by providing access to valuable working capital and a set of integrated financial services. By leveraging our end-to-end capabilities, you can confidently navigate the world of trade, maximize sales, optimize your operations, and seize every business opportunity.

How it works ?

Apply

Submit your application to begin using Corporate Alliance trade finance for your import and export needs.

Establish Limit

Once approved, a credit limit is set, giving you access to the funds necessary to pay your suppliers.

Drawdown

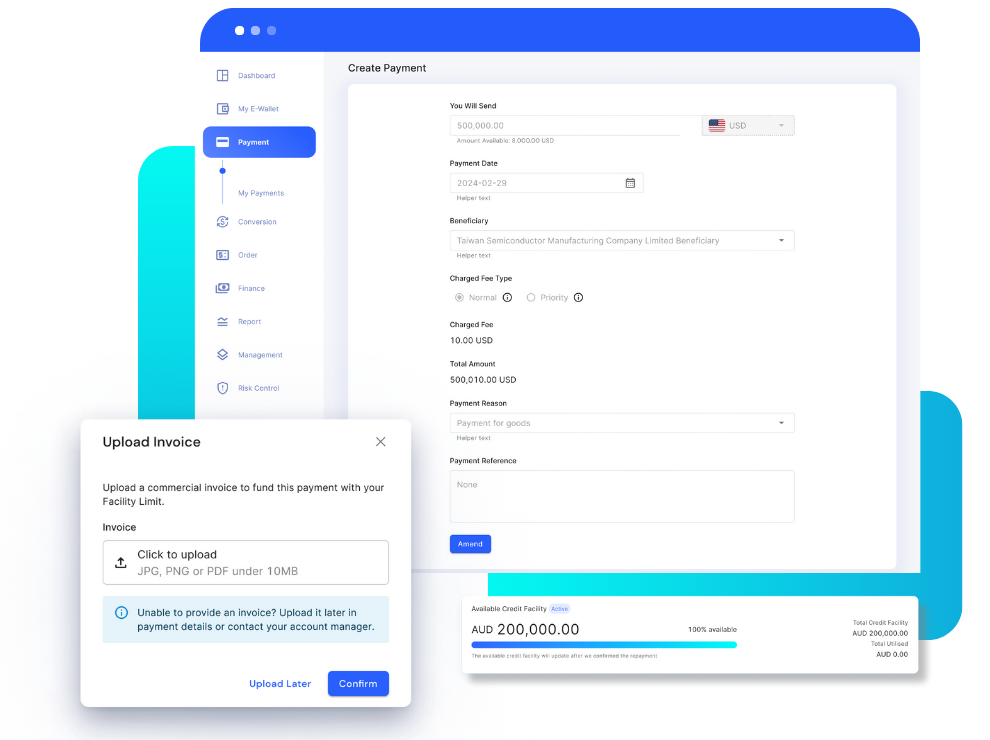

Submit your invoice to us, and we'll settle payments directly with your suppliers from your revolving line of credit.

Pay Later

Enjoy up to 60 days of interest-free repayment, giving you the flexibility to manage your cash flow effectively.

Core Benefits

Interest-Free

Interest-free repayment terms up to 8 weeks, subject to FX margin.

Competitive FX Rates

Pay domestic and international suppliers at competitive FX rates.

Quick Credit Access

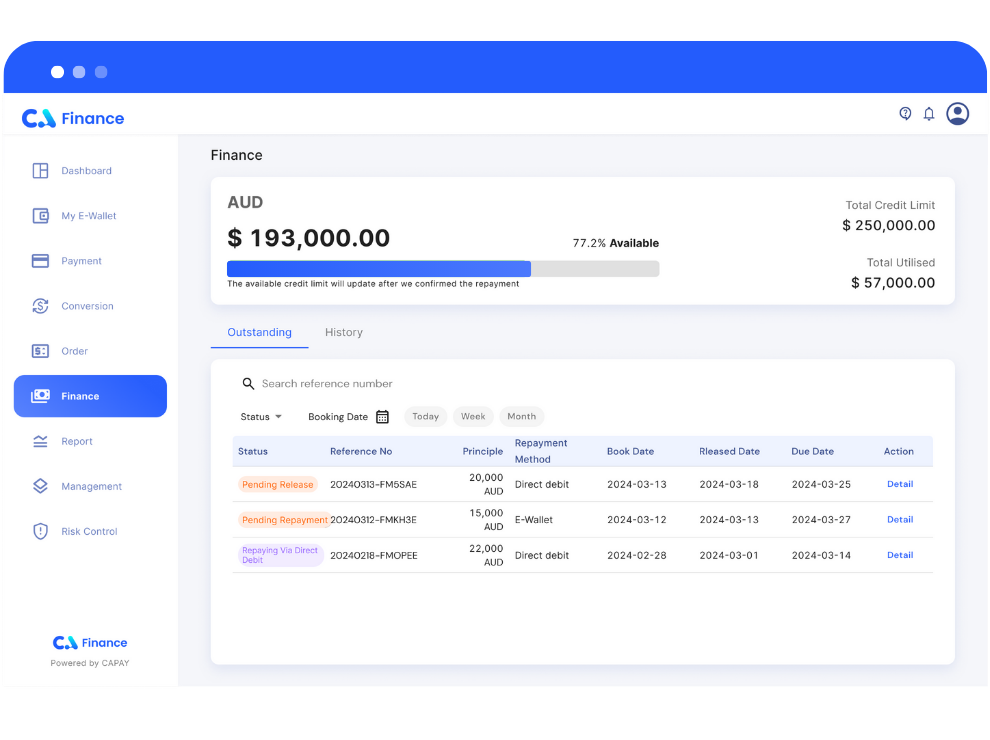

Access your revolving line of credit up to A$250,000 within 48 hours.

No Hidden Fees

No hidden fees or costs to set up or maintain your line of credit.

Why choose us?

User-friendly portal

Pay as you go costs

Get fast approval

Integrated solutions

What Our Customers Say

Find out what our customers are saying about our products.

Corporate Alliance makes everything easy. Their trade finance facility has helped us access quick liquidity, while also streamlining our trade financing activities. The online platform is very user-friendly and makes it very easy for us to manage and oversee our trade finance activities. Our account manager has been incredibly supportive and responsive to our needs. Overall, great platform and great service! We couldn’t be happier.

Laura Bennett Managing DirectorFAQ

Any business with an Australian Business Number (ABN) that is engaged in buying (importer) or selling (exporter) goods or services to other businesses on trade terms (i.e., not cash on delivery) and involving a currency other than Australian dollars.

When you apply for Trade Finance, we will assess your application and approve it based on your individual circumstances. Generally speaking, buyers and sellers who qualify need:

- To be domiciled in Australia

- Around AUD 2 million+ turnover

- To have been profitable for the last two financial reporting periods

- To have a positive balance sheet net worth

- A minimum of two years' healthy trading record

Before extending our trade finance facility, Corporate Alliance Finance conducts a credit checking procedure. Rest assured, our credit assessment process is speedy and efficient.

We do not take title over your goods or any security against yourself or the business. For specific terms of the loan, we may ask for a personal guarantee.

We require financial information to properly assess your business. This may include:

- Full two-year financials

- Monthly or quarterly management accounts

- List of aged debtors and creditors

- ATO portal - Statement of Account (SOA)

We may request additional documents for ongoing financial monitoring.

We offer credit lines of up to A$250,000 that can be used to fund invoices of any value within the funding limit. The credit period depends on your individual circumstances; we can give you up to 60 days interest-free from each funding date to repay us.

Of course! Our credit facility does not conflict with your existing banking and finance relationships. You can still use Corporate Alliance Finance even if your business has already borrowed from a bank. If more appropriate, we could even replace your bank (especially since we do not require any property as security). Using Corporate Alliance Finance also does not prevent you from borrowing money from other sources. Quite often, a business will use Corporate Alliance Finance in conjunction with a business overdraft or other debt facilities.

Yes, provided they meet our supplier criteria and are not related business entities (i.e., shared ownership). Once approved, our facility can be used to make both international and domestic payments immediately. We can pay for up to 100% of your supplier’s invoice value and also cover any freight and transit costs. No deposit is necessary. Simply pay it back to us based on the agreed terms.

Once you have submitted all the required information, the process usually takes between one to two days. If you are an existing client with Corporate Alliance FX (CAFX), it can take as little as 24 hours for you to receive the approved funds, provided you have submitted your completed account application form and security documents. If you are a new client, the process usually takes between one to two days from when you submit your completed account application form and supporting documents for us to assess your application and approve you on the Corporate Alliance Finance platform. As soon as you are approved, you will have access to the approved funds in your Corporate Alliance Finance account, ready for you to use.

The cost of trade finance is determined by the loan terms you require and are approved for. Funding costs are charged through an FX margin at drawdown. This allows us to give you interest-free repayment terms. For detailed information, please refer to our Trade Fees & Charges PDF guide.

Yes, however, while a single funding facility may help initially, it is a band-aid solution. It does not permanently resolve cash flow issues or help your business when funds are required for future supplier orders. Whether it is offering access to additional funds or helping you tackle those cash flow challenges, our goal is to promote continued business growth.

A funding limit functions as a revolving line of credit, enabling you to conveniently settle payments to suppliers and other creditors. You'll be able to borrow repeatedly up to your funding limit while repaying simultaneously.

Get in touch with one of our experts directly on (02) 9006 8888 to discuss your business needs so we can determine the right solution for your business.

The team at Corporate Alliance have been a key support for our business since 2021, providing us with the financial flexibility and support we need. Their trade finance solution coupled with their FX products, has significantly improved our cash flow and allowed us to manage our international payments efficiently. The entire process is straightforward, and the exceptional team from CA has made all the difference.

Sarah Thompson CEO & Founder